The secret to success in today’s dynamic trading environment is customization. Traders are looking for personalized experiences that are in line with their particular tactics. Leverate gives brokers the ability to offer customized solutions, including white label for forex brokers, enabling them to accommodate different customer preferences as technology disrupts the market.

Customization’s Influence on Forex Trading

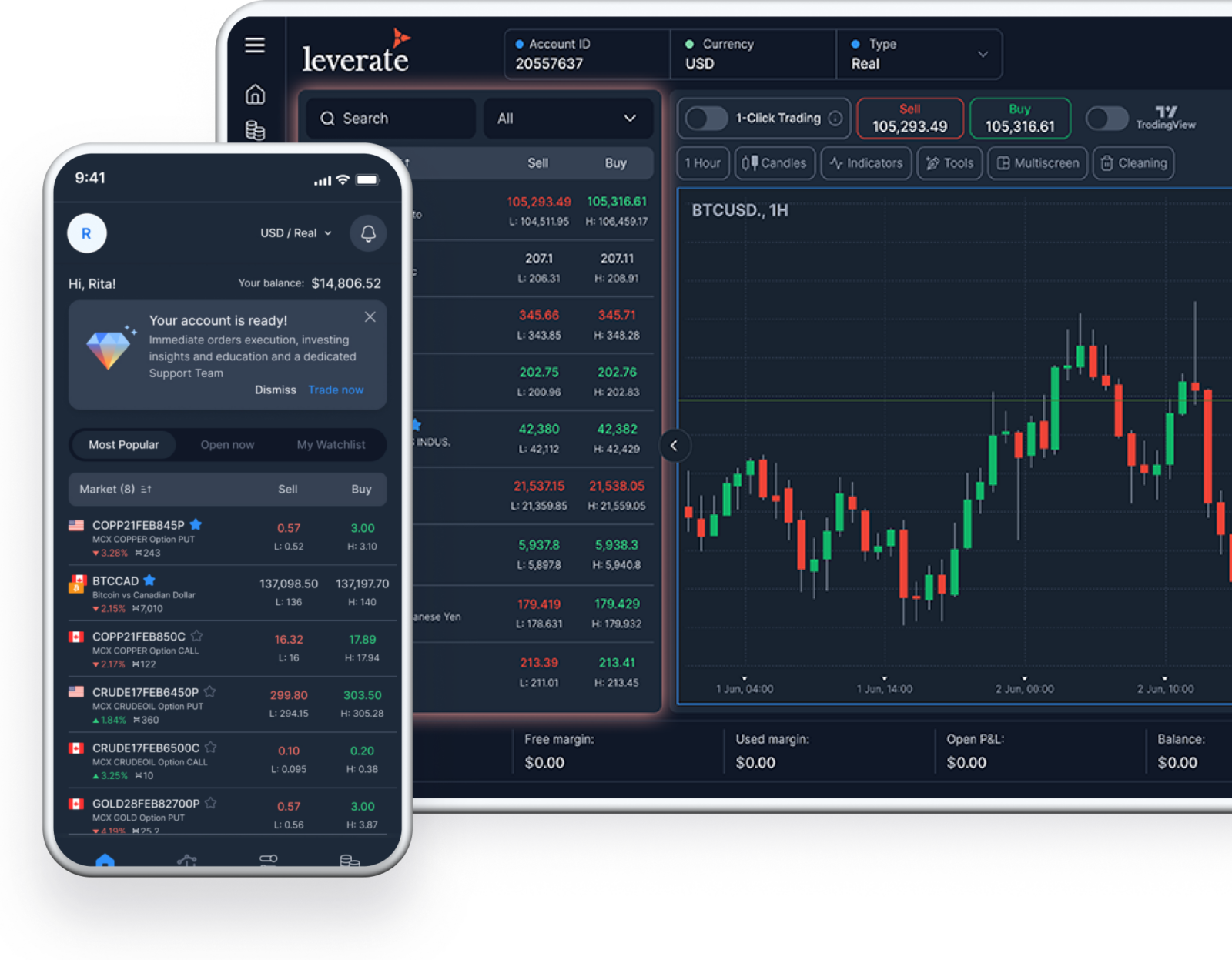

The era of generic trading platforms is over. Platforms that support traders goals and trading styles are presently in high demand. We are now living in the era of customization, when brokers may design personalized trading environments using Leverate’s white-label products. The ability to customize a workspace means that traders have a workspace that meets their demands, whether it is the design, color scheme, or trading tools.

Optimal Trading User Interface Customization

Interfaces that are easy to use and visually appealing are crucial. Brokers can design user interfaces that improve the trading experience using Leverate’s white-label solutions for mobile trading platforms. Charts, data streams, and tools can all be arranged by traders how they see fit, increasing productivity and execution speed.

Tools for Forex Trading Strategies can be customized.

Different traders use various tactics. Traders can incorporate tools and indications that are pertinent to their methods through customization. By enabling brokers to accommodate different trading styles, Leverate’s white-label Forex solutions increase client happiness and success rates.

Solutions for Crypto Payments with a Personalised Touch

Customized cryptocurrency payment gateways are in high demand as cryptocurrency trading is increasing. Leverate recognizes the value of frictionless transactions, enabling traders to deposit and withdraw money using their chosen cryptocurrencies and promoting confidence among traders.

Building Stronger Broker-Trader Relationships

Beyond just the tools themselves, customization improves the entire trading experience. Leverate’s reputable white-label brokerages provide individualized learning materials, current market analytics, and special notifications. This strengthens bonds and promotes trust among dealers.

The Future of Customised Forex Trading

The potential for customization grows as technology advances. Leverate, a pioneer in broker technology, will continue to influence the trading environment. Predictive analytics and AI-driven insights for real-time customization are what the future holds, and they will revolutionize trade experiences.

In conclusion, customization in forex trading is now a requirement rather than a luxury. The white-label offerings from Leverate, such as white label for FX brokers, enable brokers to provide custom trading environments. Brokers may increase trader engagement, pleasure, and success by embracing personalization. Leverate is dedicated to using customization to influence the development of trading technology and techniques as the trading industry changes. Learn how to launch a forex broker with Leverate and begin your ascent to industry hegemony.