For prop firms aiming to carve out a competitive edge, three factors stand out as non-negotiable: liquidity, leverage, and execution. These aren’t just buzzwords, they’re the cornerstones that can either propel a firm to success or leave it scrambling for survival in a crowded marketplace. But what makes these pillars so crucial to a firm’s success? More importantly, how can a prop firm optimize them to drive profitability? Let’s break it down, and we’ll show you how Leverate’s advanced solutions can turn these foundational concepts into a real advantage.

The Power of Liquidity: Fueling Your Firm’s Growth

Liquidity, in trading, refers to the ease with which assets can be bought or sold in the market without affecting their price. High liquidity ensures smoother trades and less slippage, which can significantly impact profitability, especially for prop firms with high-frequency traders.

A well-functioning liquidity system can also create opportunities by giving traders the freedom to execute their strategies without worrying about market gaps or waiting for large price movements. This is where Leverate’s liquidity solutions can help. Leverate provides cutting-edge liquidity aggregation tools that allow prop firms to access deep pools of liquidity across various asset classes. With access to diverse liquidity sources, prop firms can provide their traders with competitive pricing and minimize the risks of trading on illiquid markets.

“Liquidity is key for prop firms because it ensures trades happen quickly and at fair prices, which is crucial for maximizing profits in fast-moving markets.” – Leverate Insights.

Furthermore, liquidity aggregation tools offered by Leverate allow prop firms to manage their risk better and ensure that they’re never caught off guard in volatile market conditions. Whether you’re dealing with forex, CFDs, or cryptocurrencies, liquidity ensures that your traders can execute their strategies and complete challenges with confidence.

Leverage: Unlocking Greater Profit Potential

Leverage is a double-edged sword. On one hand, it gives traders the ability to control larger positions, potentially increasing their profits. On the other hand, it amplifies risk, and improper leverage use can lead to significant losses. In the high-stakes world of prop trading, understanding how to leverage effectively is key to ensuring both profitability and risk control.

Leverate’s solutions offer flexible leverage settings that are customizable depending on the asset class, trader risk profile, or even market conditions. Whether your traders are executing short-term strategies on forex pairs or managing long-term CFD positions, you can tailor the leverage to fit their needs while ensuring that the firm’s risk management strategies are intact.

But here’s the magic, Leverate’s SiRiX Broker is an all-in-one risk management tool which was built to help prop firms maintain a healthy balance between reward and risk. Features like max daily profit, discount codes, automatic margin calls, stop-loss orders, and real-time risk analytics allow the firm to adjust leverage dynamically, depending on market conditions. It’s like having an experienced risk manager in your corner, always ensuring that your firm doesn’t overextend while still offering traders the freedom to take advantage of opportunities.

Stat Fact

According to a study from the International Organization of Securities Commissions (IOSCO), firms that use dynamic leverage models with automated risk management systems are 30% more likely to succeed in maintaining profitability during volatile market conditions.

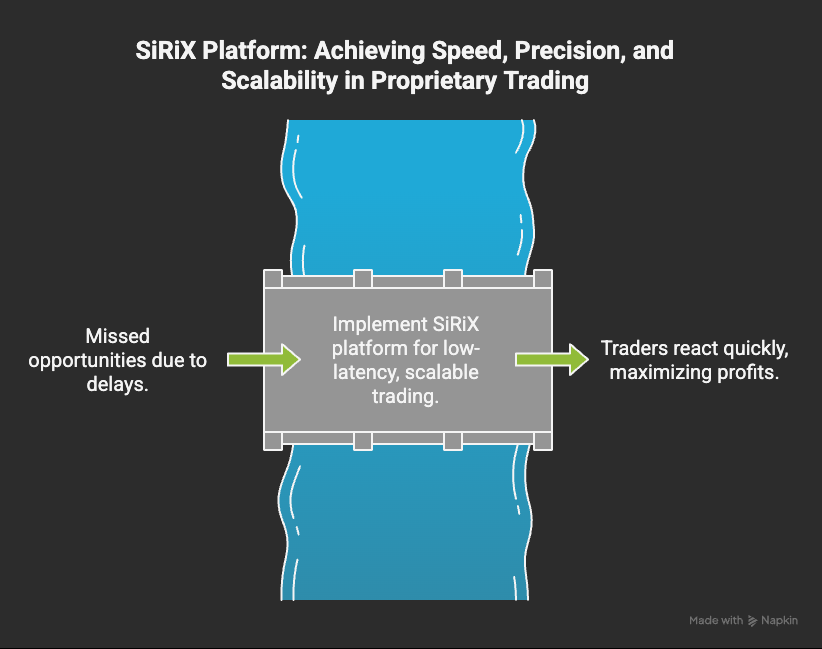

Execution: Speed, Precision, and Scalability

Execution speed and precision are often overlooked, but in prop trading, a split second can mean the difference between profit and loss. Prop firms live and die by their ability to react quickly to market movements, and a sluggish execution platform is a liability. Traders need to get in and out of positions at the right time, and firms need to ensure that their infrastructure supports high-speed trading without compromising accuracy.

Leverate’s SiRiX platform is designed with speed and reliability in mind. The execution engine is optimized for low-latency environments, ensuring that your traders can place and modify trades in real-time. With TradingView chart integration and access to real-time market data, the platform enhances execution efficiency, giving traders the tools they need to succeed.

What’s more, SiRiX’s scalability ensures that as a prop firm grows, your platform can scale seamlessly without compromising on performance. Whether you’re dealing with increasing trade volumes or complex order types, SiRiX ensures that your firm maintains high-speed execution, making it a competitive advantage in the marketplace.

Bringing It All Together: Why These Pillars Matter

Liquidity, leverage, and execution are the essential pillars for any successful prop firm. Without these key elements, your firm faces significant challenges: insufficient liquidity leads to slippage, poor execution results in missed opportunities, and mismanagement of leverage can quickly diminish profits. These pitfalls make it harder to maintain a competitive edge.

By optimizing these pillars, you’re not only setting your firm up for success, but you’re also enabling your traders to perform at their best. Leverate’s solutions—from liquidity aggregation to dynamic leverage models and fast execution—ensure that your firm has the tools necessary to thrive in today’s fast-paced prop trading world.

Leverate’s flexibility, combined with the deep configurability of our ecosystem, means that you can customize your approach to liquidity, leverage, and execution to meet your unique firm requirements. Whether you’re an established prop firm or just starting, Leverate ensures that you have everything you need to scale quickly and efficiently.

Are you ready to elevate your prop firm with the right tools for growth? Discover how Leverate’s advanced liquidity, leverage, and execution solutions can help you build a more profitable and scalable prop firm.