What Is a White Label Forex Platform?

Launching a forex brokerage can seem daunting, especially for entrepreneurs without a development team or technical background. That’s where a white-label forex platform comes in, a solution that allows brokers to enter the market quickly, affordably, and at scale. In this guide, we’ll explore what white label forex platforms are, how they work, and why they’ve become essential to the new wave of fintech and brokerage startups.

What Is a Forex Platform and Who Needs One?

A forex platform is the core technology that enables trading in the foreign exchange (Forex) market. It provides access to currency pairs, market data, analytical tools, and the execution of trades. Whether you’re launching a CFD brokerage, scaling a prop firm, or entering the fintech space, the platform is where all your client interactions and trades happen.

Who Needs a Forex Platform?

- Aspiring brokers looking to offer trading services to clients

- Fintech startups entering the trading space

- Prop trading firms managing teams of funded traders

- Financial educators launching demo-based communities

Setting up a proprietary platform, however, is often prohibitively expensive. That’s where white label solutions offer a smarter alternative.

What is a White Label Platform?

A white label forex platform is a pre-built, customizable trading platform that can be branded and operated by another company as its own. Instead of developing the entire tech stack from scratch, you license the backend from a technology provider and add your own brand, design, and client-facing workflows.

How It Differs From Non-White-Label Solutions:

| Feature | White Label Platform | Non-White-Label (Custom Build) |

| Time to Launch | 30–60 days | 12+ months |

| Cost | Low to moderate | High (development + maintenance) |

| Custom Branding | Yes | Yes |

| Technical Team Required | Minimal | Large |

| Compliance Tools | Built-in | Must be built |

| Updates & Maintenance | Handled by provider | Broker responsibility |

This plug-and-play approach lets entrepreneurs focus on marketing, conversion, and client acquisition instead of technology headaches.

The Benefits of a White Label Forex Platform

The rise in demand for white label platforms reflects their practicality and scalability. Here’s why more brokers are choosing this route:

1. Fast Time to Market

You can launch in weeks, not months. Leverate, for example, supports full go-live within 30 to 60 days.

2. Reduced Upfront Costs

No need to hire developers or maintain servers. Licensing dramatically cuts startup expenses.

3. Full Branding Control

Your logo, your domain, your brand. The user experience is yours to own.

4. Regulatory & Compliance Support

White label providers offer built-in tools like KYC flows, data protection, and risk controls.

5. Access to Premium Tools

From TradingView charts to CRM dashboards, you get enterprise-grade features out of the box.

6. Scalability

Start small and scale up, adding languages, payment integrations, or expanding into prop trading with zero development work.

According to Finance Magnates (2023), over 60% of new forex brokerages now adopt white label platforms due to faster deployment and lower setup costs.

Powering Growth with Leverate’s Ecosystem

With Leverate, you get more than a white-label platform; you get a performance-focused, turnkey brokerage infrastructure.

- SiRiX Trading Platform: Seamless cross-device trading, integrated TradingView, social trading, limit/stop order panel, and support for both netting and hedging accounts.

- SiRiX Broker: An advanced broker-side management tool to control trading conditions, apply dynamic configurations, and oversee operational setups without needing dev support.

- Broker Portal: Configure plans, payouts, leverage, and evaluation logic for both CFD brokers and prop firms.

- Client Zone: Traders purchase challenges, upload documents, and track status in real-time. Fully self-service.

- Leverate CRM: Manage leads, segments, affiliates, and communication workflows.

This all-in-one structure simplifies launch and boosts retention.

What Makes a Great White Label Forex Provider?

Choosing the right white label partner is mission-critical. Here’s what to look for:

- Proven Track Record: Years of experience in building compliant, secure trading platforms.

- Support & Training: Onboarding guidance, dedicated account managers, and 24/5 tech support.

- Flexible Architecture: Modular components (CRM, trader zone, backend) you can configure as you grow.

- High Performance: Low latency trade execution, server stability, and uptime guarantees.

- Localization: Ability to adapt to different markets, regulations, and languages.

What to Look for in a White Label Forex Platform

Before you commit, audit the platform across these dimensions:

- Cross-Device Compatibility: Web, mobile, and desktop versions must be seamless.

- TradingView Integration: Widely trusted charting tool that enhances UX.

- Built-in CRM: Manage leads, track affiliates, automate onboarding.

- KYC/AML Flow: Secure identity verification baked into the funnel.

- Risk Management Tools: Leverage control, stop-out levels, margin alerts.

- Multilingual Support: Essential if you plan to serve global traders.

- Custom Reports & Analytics: Visualize business performance without dev support.

The more features integrated from day one, the easier it is to grow sustainably.

Why SiRiX Beats Legacy Platforms

Many brokers still rely on MT5 or other legacy systems. Here’s why SiRiX stands out:

- CRM + Broker Portal integration

- Unified experience across mobile/desktop

- Built-in social trading + PAMM-style logic

- Support for Netting and Hedging

- Smart order panel: Limit/Stop logic

- No extra TradingView fees

This eliminates platform fragmentation and enhances trader retention.

Support for Hybrid Models

Modern firms are launching hybrid brokerages that offer both CFD and Prop Trading models. Leverate’s platform supports both models in one interface, with clear logic separation.

- CFD side: deposit, leverage, withdrawal logic

- Prop side: purchase challenges, retry logic, leaderboards, funded accounts

This allows brokers to diversify revenue streams and serve multiple audiences.

Marketing and White Label Forex

Having your own branded platform opens up huge marketing advantages.

- Own the Funnel: Build your email list, run retargeting campaigns, and personalize the user journey.

- SEO Benefits: Rank your brand’s site for “forex trading”, “prop firm challenges”, and long-tail keywords.

- Conversion Optimization: Tailor onboarding and challenge flow to maximize signup-to-deposit ratio.

- Affiliate Tracking: Scale outreach using a built-in affiliate system.

Marketing is no longer limited by technology. It’s empowered by it.

An Example Game Plan for Launching a Forex Brokerage

Launching a brokerage is less about building everything from scratch and more about choosing the right components.

Suggested Timeline (Based on Leverate Model):

Week 1–2: Discovery and Planning

- Define business model (retail, prop, hybrid)

- Choose white label provider

- Confirm legal jurisdiction

Week 3–4: Onboarding and Branding

- Customize SiRiX platform: logo, domain, color scheme

- Set up CRM workflows and onboarding paths

- Configure payment gateway integrations

Week 5–6: Go Live and Market

- Run internal tests and sandbox trades

- Launch marketing campaigns (email, PPC, SEO)

- Start onboarding live clients

From idea to revenue, it’s possible in two months with the right partner.

Practical Tips

- Start Lean: Focus on quality leads and build strong funnels before scaling up.

- Use Demo Challenges: Great for training traders and converting them into real-money users.

- Offer Live Support: Chat widgets and multilingual agents boost trust.

- Track Everything: Use CRM dashboards to optimize acquisition and retention.

- Educate Continuously: Run webinars, tutorials, and daily briefings to build loyalty.

Common Mistakes to Avoid:

- Relying solely on marketing without platform polish.

- Choosing providers without clear SLAs or regulatory expertise.

- Ignoring mobile UX (most trades happen on mobile!).

- Underestimating support needs during peak trading hours.

How Leverate’s White Label Platform Stands Out

Leverate has developed a modular ecosystem that helps brokers launch faster, convert better, and scale smarter. Here’s how:

SiRiX Trading Platform

A responsive, branded multi-device platform built for both new and experienced traders. Integrated with TradingView, one-click execution, and real-time analytics.

Leverate CRM

Track leads, manage affiliates, and automate KYC. Fine-tuned for financial services.

Broker Portal

Exclusively for prop firms, the Broker Portal allows configuration of leverage, payout structures, and trader evaluation rules.

Client Zone

A self-service dashboard for traders to upload documents, join challenges, and monitor account status.

Prop Firm Toolkit

Offer trading challenges with automatic evaluation, funding logic, and payouts.

“White label platforms are no longer an alternative, they’re the industry default,”- Leverate Insights.

With Leverate, brokers launch with a full-stack solution and no technical debt.

FAQs

Q: What is a white label forex platform?

A white label forex platform is a fully functional trading environment provided by a third party but branded as your own.

Q: Who should consider a white label solution?

Brokers, fintech founders, educators, and prop trading firms that want to go to market fast without building tech in-house.

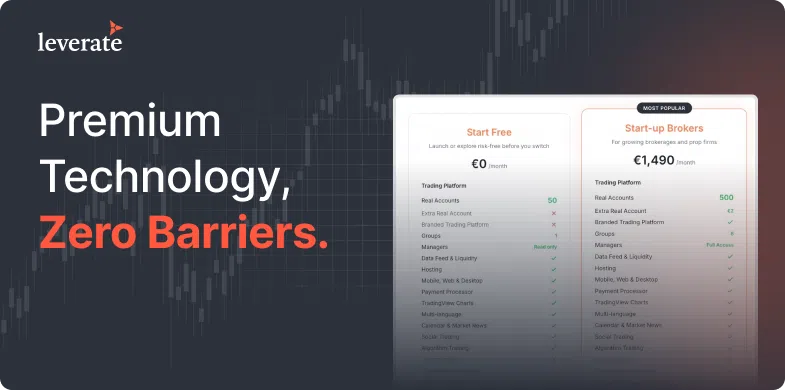

Q: How much does it cost to start?

Costs vary by provider and scale. Leverate offers packages tailored to startup needs.

Q: Is it safe and compliant?

Yes, with the right partner. Reputable white label providers offer tools for data protection, KYC, and regulatory alignment.

Q: Can I customize the experience?

Absolutely. Your domain, logo, onboarding path, payment systems, all can be configured.

Q: How fast can I launch?

With Leverate, launch is possible in as little as 30–60 days.

Conclusion

White label forex platforms have transformed the industry by making it easier than ever to launch a professional-grade brokerage. They reduce costs, accelerate launch timelines, and eliminate technical headaches, allowing founders to focus on what matters: growth.

With technology such as the SiRiX trading platform, Leverate’s CRM, SiRiX Broker (for CFD brokers), Broker Portal (for prop firms), and the Client Zone, Leverate delivers an end-to-end white-label solution that puts your brand front and centre. Whether you’re launching your first forex brokerage or prop firm, expanding globally, or shifting from educator to broker, Leverate helps you go live, stay compliant, and scale profitably.