2023 did not bring the expected recovery from 2022 market plunge and for those who have survived last year, 2023 will make or break many brokers. As a result, the online brokerage industry is competitive than ever before, surfacing those who provide added value to their traders and who will probably cross the line to 2024. For brokers, added value comes in many forms, and for the average online brokerage, this year will revolve around innovative technology and user trading experience. We’ve narrowed it down to the top four elements that your brokerage MUST HAVE to remain at the forefront of this cutthroat market:

Super-Friendly Interface

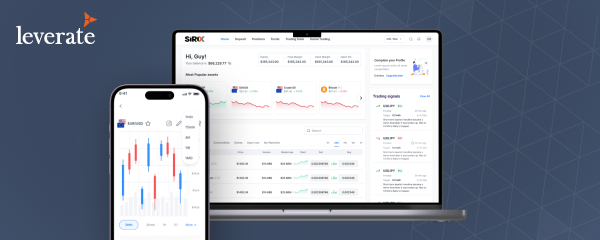

What constitutes a super-friendly trading interface? First of all, design and functionality should be top notch, state-of-the-art, appealing and intuitive, making it user-friendly and easy to navigate. Features should have clear tool tips, so that traders (even beginners) know exactly what to do and are able to take advantage of all the platform has to offer. We’re looking at one-click executions, so that traders can open a position without delay. We’ll need efficient and organized dashboards, so that the trader can get to where they want on the platform without wasting time searching around to perform or be in-the-know regarding their history, present activity, or status. They should have easy access to the most advanced charts and indicators so that they’re equipped with all knowledge necessary to make the most educated trades.

Cross-platform Compatibility and Availability

In order to improve trader engagement, brokerages must implement a cross-platform strategy that provides traders with a seamless experience across various devices. This includes web, desktop, and mobile applications. The mobile app is particularly important as it offers a competitive edge. A brokerage should have a native mobile app that allows for instant account access, simple log-in, tracking of P/L, margins, and open/closed positions, and real-time market data with advanced charting tools. The latest features, such as cryptocurrency and social trading, should also be accessible through the mobile app.

AI and Automation

AI trading is a powerful tool for analyzing data and identifying patterns that can be difficult for humans to recognize. Automation is also important for the sales and marketing teams, as it enables the automation of repetitive market tasks like email campaigns and social media posts. An AMS can use data analytics to target specific client segments, improving the efficiency and effectiveness of outreach efforts.

Cryptocurrency and Social Trading

Offering cryptocurrency and social trading is essential to demonstrate innovation and a willingness to adapt to changing market trends. These features can significantly diversify offerings, expand target audiences and markets, and position a brokerage as an industry leader.

Summary

In summary, these are the must-have features for online brokerages in 2023. Understanding trader needs is crucial in this dynamic market, and implementing these features can help to stay ahead of the game.