The forex industry is in the middle of a full-blown tech renaissance. It’s no longer enough for platforms to be stable and secure, they need to be intelligent, instinctive, and invisible in how they assist traders. Whether you’re a broker looking to future-proof your operations or a trader trying to stay competitive, understanding the technologies shaping 2025 is not optional, it’s survival.

Let’s break down exactly what’s transforming and how you can stay ahead, especially with fintech leaders like Leverate paving the way.

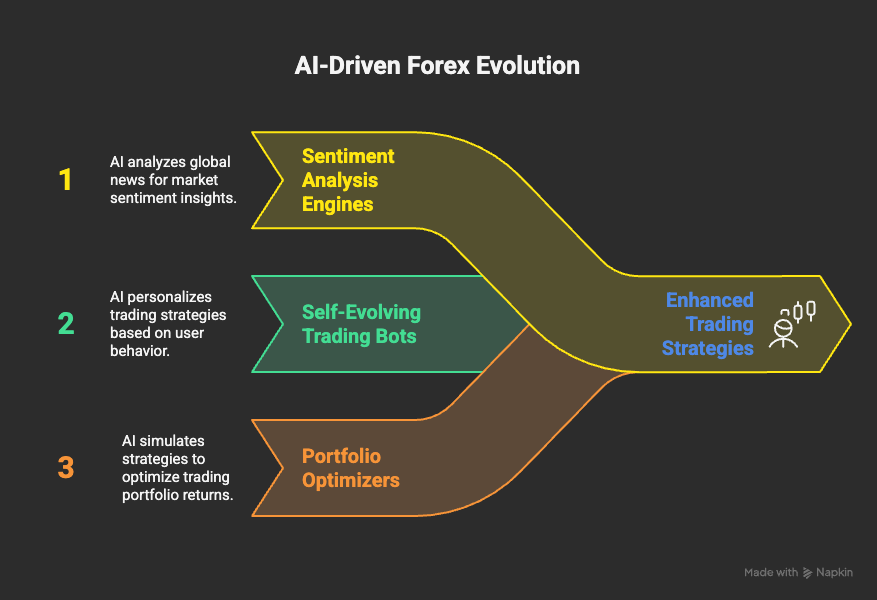

AI-Powered Trading Intelligence

AI in forex technology is no longer just about automating trades, it’s about thinking ahead of the market. Platforms are evolving into virtual analysts, capable of digesting millions of data points in seconds and suggesting precise, context-aware trading moves.

What’s Changing in 2025:

- Sentiment Analysis Engines: AI will scan global news, central bank updates, social media, and even Reddit forums, instantly gauging market mood. For instance, if an unexpected policy statement drops from the ECB, your AI module might instantly recommend adjusting your EUR/USD exposure before the market reacts.

- Self-Evolving Trading Bots: No two traders are the same. AI bots will now personalize strategies by learning a user’s trading history and behavior curating everything from risk tolerance to preferred trading times.

- Portfolio Optimizers: These engines simulate thousands of strategy combinations using years of historical data and real-time volatility metrics to maximize returns. It’s like having a mini hedge fund analyst team working in the background.

A study by Deloitte shows that 63% of financial firms are already deploying AI to improve trading outcomes, a number expected to exceed 85% by 2025 (Deloitte AI Report).

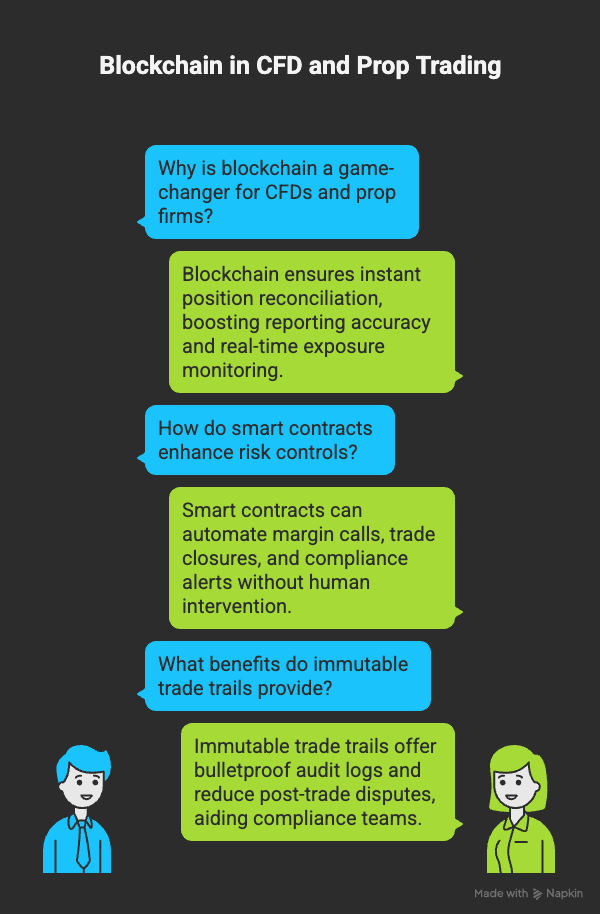

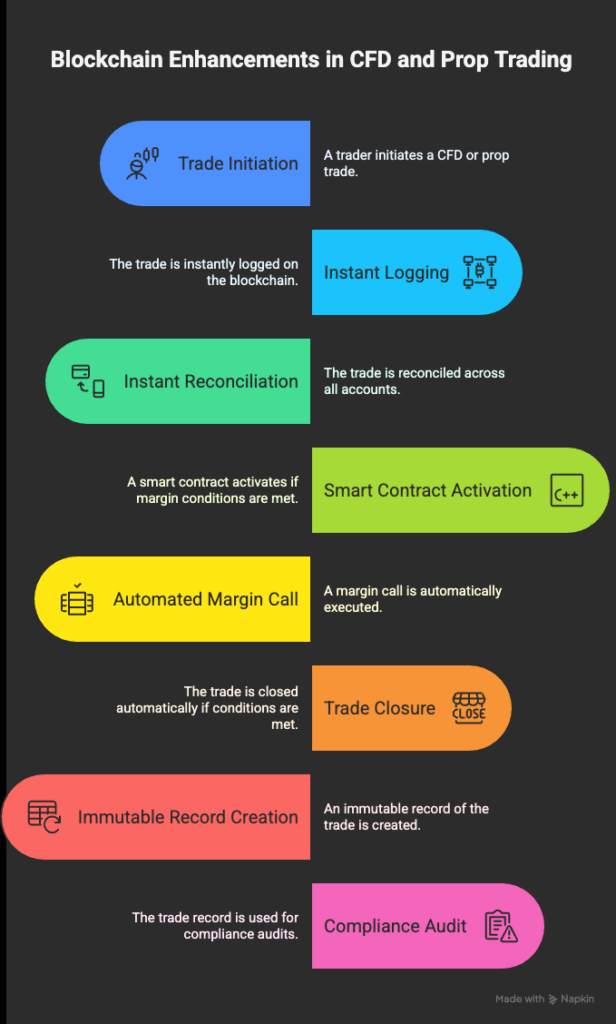

Blockchain in CFD and Prop Trading: Real-Time Transparency and Trust

In the high-leverage space of CFD and prop trading, speed and clarity are everything in forex technology. Blockchain technology, especially in private ledger formats, is now reshaping how trades are recorded, reconciled, and audited without the typical intermediaries slowing things down.

Fun Fact

In fact, the global market for blockchain in finance is projected to hit $100 trillion by 2032, underlining its growing dominance in fintech (Statista).

Biometric and Behavioral Security

With cybersecurity threats evolving, multi-layered biometric security is emerging as a key forex trading technology in 2025. It not only boosts platform safety but also creates a frictionless experience for traders.

Innovations in 2025:

- Facial Recognition on Mobile Apps: Forget passwords. Traders can now unlock their platforms with a glance, thanks to deep-learning facial scan models integrated into mobile apps.

- Voiceprint Authentication: Particularly powerful for voice-based customer support. Your client says “Check my open trades,” and the system confirms it’s them and not an impostor.

- Behavioral Analytics: Platforms monitor keystroke dynamics, scroll patterns, and session habits. If someone logs in from a familiar IP but behaves differently (e.g., faster clicks or unusual navigation), the system flags or locks the session.

This forex trading technology not only protects accounts but also enables AI-driven fraud detection systems to flag suspicious transactions in real-time.

Cloud-Native and Mobile-First Platforms

By 2025, trading doesn’t happen at desks, it happens on the move, in real-time, and across multiple screens. Platforms must be cloud-native to scale, and mobile-first to be usable.

Key Features You’ll See:

- Progressive Web Apps (PWAs): Apps that feel native on any device without needing to download them. It’s like having your MT4/MT5 running inside Chrome, with full speed and charting functionality.

- Voice-Based Trading: “Buy 5 lots of GBP/USD” said aloud will trigger a confirmation prompt, great for multitaskers or accessibility-focused users.

- Cross-Device Continuity: Start analyzing a trade on your laptop, execute it from your tablet on the train, and check your profits from your phone while waiting in line for coffee.

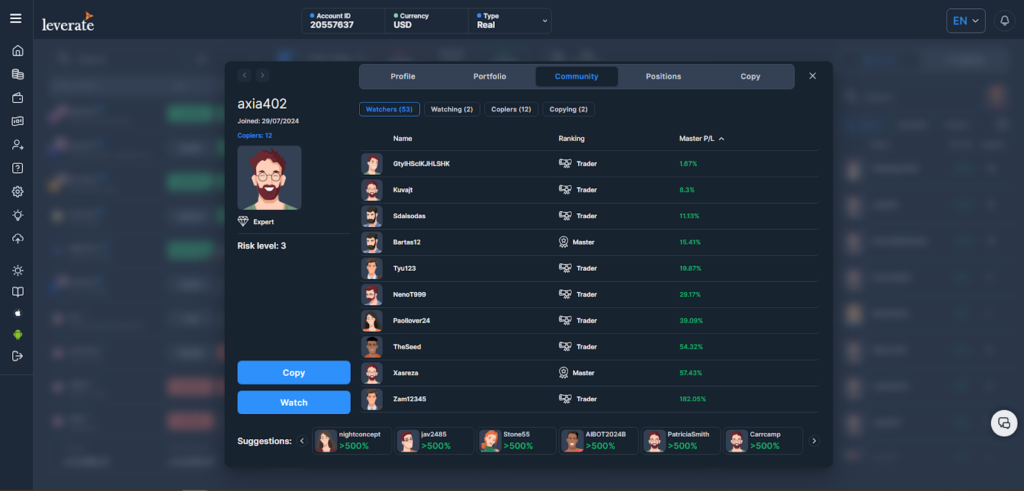

Social and Copy Trading 2.0

In 2025, social trading will go beyond simply mirroring strategies, it’s becoming intelligent, educational, and interactive.

What to Expect:

- Dynamic Ranking Systems: Not just based on profits, but on consistency, drawdown, and strategy complexity.

- AI Matchmaking: Like dating apps for trading, platforms pair followers with traders that match their risk appetite, time commitment, and even preferred markets.

- Embedded Strategy Tutorials: Traders will be able to livestream strategy sessions inside the platform, or publish trade journals for followers.

Ideal for Gen Z traders who grew up on TikTok and want learning baked into the process.

Join the social trading wave. Discover SiRiX Social by Leverate.

RegTech: Compliance Without the Complexity

Regulatory technology, or RegTech, is enabling brokers to comply with increasingly complex rules across jurisdictions without adding manual burden in forex technology.

What It Looks Like:

- AI-Powered KYC/AML: Automatically scans passports, verifies selfies, and cross-checks user data against global watchlists.

- Jurisdiction-Specific Alerts: Smart dashboards highlight what rules have changed, and what actions need to be taken for each client segment.

- Suspicious Activity Monitoring: Back-end algorithms spot outlier transactions and flag them for compliance officers in real-time.

This reduces legal risks and allows brokers to expand globally with confidence.

Are You Ready for the Next Era?

2025 will not be business as usual in the forex world. With rapid advancements in forex technologies from AI and blockchain to mobile and RegTech, brokers and prop firms need to modernize or risk becoming obsolete.

Every day you delay upgrading your tech stack, your competitors are gaining ground. Traders want smarter tools, faster platforms, and deeper insights and Leverate is helping brokers and prop firms deliver all of that now, not later.

Whether you’re a new broker or firm, or scaling globally, technologies from us will be your secret weapon for staying competitive.

Don’t just adapt lead the change. Contact Leverate today and build your brokerage for the future.