Flexibility and efficiency are critical to success in CFD trading, and at Leverate, we continuously evolve to meet those demands. Our latest update to the SiRiX trading platform introduces full support for Netting accounts, empowering brokers with a more streamlined, versatile trading environment. With this enhancement, SiRiX now supports both Netting and Hedging account types, all within a single, unified platform, giving traders the freedom to choose the strategy that suits them best.

This enhancement reflects our commitment to adapting to the evolving needs of Forex and CFD brokers, providing them with the tools to meet diverse trader preferences while streamlining operations.

Understanding the Value of Netting

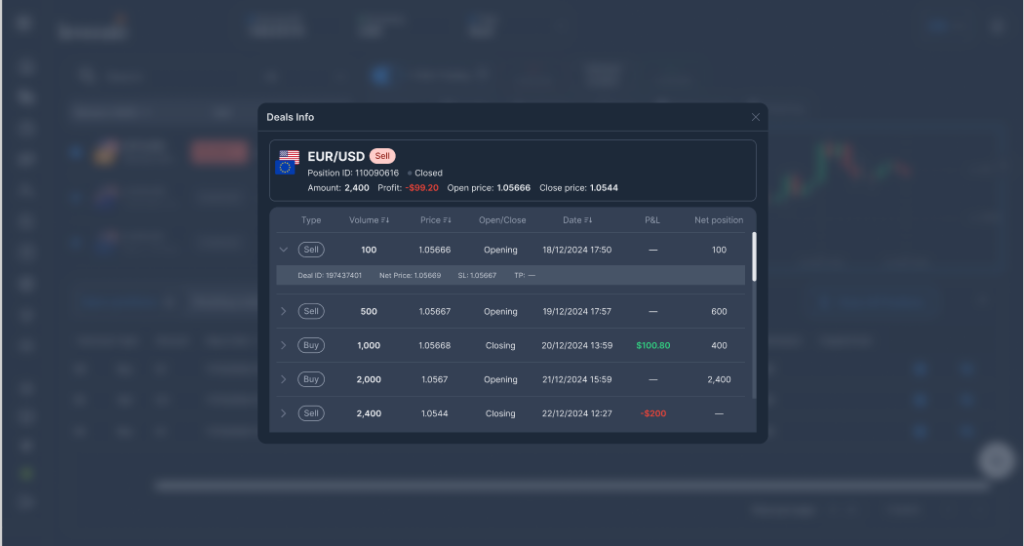

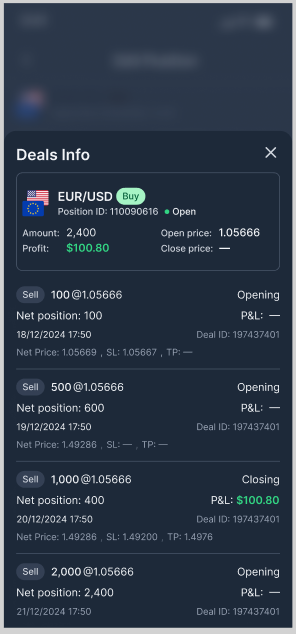

Netting accounts consolidate all open positions in a given asset into a single position, displaying only the net result of trades. For brokers, this means reduced system complexity and easier exposure tracking. For traders, it translates to a more streamlined view of their portfolio and improved management of open positions.

Key benefits of Netting accounts include:

- Simplified exposure monitoring through position consolidation.

- Clearer TP/SL calculations with one position per asset.

- Reduced insolvency risk through automatic offsetting of opposing trades.

- Enhanced user experience with an intuitive trading setup.

These benefits not only improve operational efficiency but also contribute directly to a more satisfying trading experience, ultimately supporting higher client retention and conversion rates.

Flexibility with Netting and Hedging in One Platform

Rather than limiting brokers to a single trading approach, SiRiX now empowers them with dual-mode support. Traders can choose between Hedging, where each trade remains independent, or Netting, which merges trades into a net position. This flexibility caters to both risk-averse investors and high-frequency strategists, without requiring multiple platforms or added complexity.

This strategic enhancement also gives brokers a significant competitive advantage. By enabling diverse trading preferences, brokerages can expand their client base by catering to diverse geolocations, each with unique investment strategies and needs, while simultaneously minimizing onboarding friction and support inquiries.

What This Means for Brokers

The integration of Netting into the SiRiX platform offers more than just convenience, it’s a performance driver. As a broker, you gain:

- A wider appeal to different trading styles.

- Greater client autonomy and satisfaction.

- Lower operational friction from consolidated account structures.

- Increased efficiency in back-office systems.

Most importantly, it’s a value proposition that resonates with prospective traders. When presented with a platform that adapts to their needs rather than restricting them, the decision to open an account becomes much easier, contributing to higher conversion rates and stronger client loyalty.

A Strategic Addition to Leverate’s Ecosystem

This update further positions Leverate’s SiRiX as one of the most adaptive and broker-friendly platforms in the market. By continually evolving to meet broker and trader demands, we reinforce our role as a trusted technology partner in the competitive world of FX and CFD brokerage.

If you’re looking to differentiate your brokerage, improve client engagement, and streamline operations, the new Netting feature in SiRiX provides the flexibility and sophistication your business needs.

Ready to offer your clients more choice and better control?

Contact us to offer your clients netting