Prop trading is shaking up the financial markets, with more firms than ever jumping into the game. But what does this mean for CFD brokers? Are they competing with prop firms, or is there room for both models to thrive?

In this article, we’ll explore the growth of prop trading, its impact on CFD brokers, and how businesses can adapt to stay ahead.

What’s Driving the Growth of Prop Trading?

Prop trading firms use their own capital to trade rather than relying on client funds, which means they take on all the risk but also benefit rewards through profit share. In recent years, several factors have contributed to their rapid rise:

- Technology & Accessibility With advanced trading platforms, real-time analytics, and automation, firms can execute complex strategies with ease.

- Market Volatility The 2020s have seen wild market swings, creating opportunities for skilled traders.

- Lower Barriers to Entry Traders can now join funded accounts without needing substantial starting capital.

- Social Trading & Communities Prop firms encourage collaboration, attracting talent from around the world.

This surge in proprietary trading has created a shift in trader expectations, especially for retail traders who might otherwise have turned to CFD brokers.

Are CFD Brokers Losing Traders to Prop Firms?

While prop trading firms are on the rise, this doesn’t mean the end for CFD brokers. However, there are clear changes in trader behavior:

Changing Preferences

Traders who might have started with CFDs are now exploring prop firms due to:

Access to Higher Capital Instead of trading their own money, traders get funded by prop firms.

Performance-Based Rewards Successful traders earn payouts based on their profit splits.

No Personal Risk With funded accounts, traders aren’t risking their own savings.

But this doesn’t mean CFD brokers are out of the picture. Many traders still prefer the flexibility and control that comes with CFD trading.

The Challenges CFD Brokers Face

While demand for CFD trading remains strong, brokers need to adapt to:

Increased Competition The appeal of funded trading accounts is pulling some traders away.

Higher Expectations Traders now want more features, better execution, and educational resources.

Regulatory Pressure As CFDs face tighter regulations in some regions, traders might seek alternative ways to trade.

How CFD Brokers Can Stay Competitive

Instead of seeing prop firms as competition, CFD brokers can evolve by incorporating the best aspects of prop trading. Here’s how:

Offering Funded Account Programs

Some brokers are already exploring hybrid models offering funded trader programs alongside traditional CFD accounts. This gives traders the best of both worlds: the flexibility of CFDs with the potential capital boost from a prop-like structure.

Enhancing Trading Platforms

To retain traders, CFD brokers need to ensure their platforms offer:

Ultra-fast execution speeds

Advanced trading tools

Social & copy trading features

Improved Risk Management & Education

Prop firms appeal to traders because they provide structured risk management. CFD Brokers who offer similar guidance, along with trading education and risk control tools, can increase trader retention.

Leverate Helping Both CFD Brokers & Prop Firms Thrive

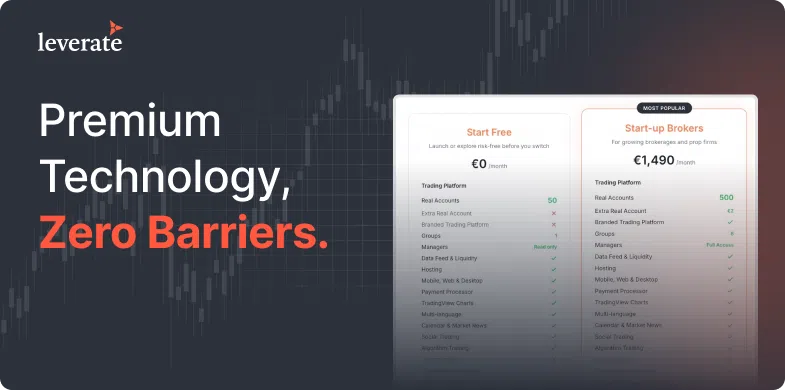

As financial trading continues to grow and change, both CFD brokers and prop trading firms need cutting-edge technology and strong infrastructure to stay ahead. This is where Leverate provides a game-changing advantage.

For CFD brokers, we deliver a comprehensive suite of solutions, including our state-of-the-art SiRiX trading platform, advanced CRM systems, and deep liquidity services that ensure seamless execution, enhanced trader engagement, and optimal operational efficiency.

Meanwhile, for prop trading firms, we offer turnkey prop trading solutions designed to streamline operations, from funding structures to risk management tools that protect both traders and firms.

By integrating Leverate’s technology, CFD brokers and prop firms alike can enhance their trading environments, attract more traders, and scale efficiently. In a rapidly evolving market, staying competitive means leveraging the best tools available and with us, both CFD brokers and prop firms have everything they need to thrive.

Contact us to see how we can help get your CFD brokerage or prop firm up and running ahead of the competition.