What is an MT5 White Label and How Much Does It Cost?

The forex industry moves fast, where speed, technology, and trust decide who thrives. For aspiring brokers and ambitious prop firms, entering the market no longer requires millions in infrastructure or years of licensing delays.

An MT5 White Label solution offers the perfect balance of agility and credibility, giving new brokers a direct route to launch their own branded trading environment, without the cost or complexity of a full MetaTrader license.

In this guide, we’ll unpack what an MT5 White Label really is, what it includes, the legal framework behind it, and how to calculate the true cost of going live.

What is an MT5 White Label Trading Solution?

An MT5 White Label trading solution allows brokers and financial firms to operate on the globally recognized MetaTrader 4 (MT5) platform under their own brand, without purchasing a full MT5 server license from MetaQuotes.

In a White Label setup, a technology provider such as Leverate supplies the underlying MT5 infrastructure, hosting, server maintenance, and liquidity connectivity. At the same time, the broker operates under its own name, logo, and unique client interface.

In simpler terms, you’re renting the technology backbone while owning the brand experience.

Key Components of an MT5 White Label Solution

A professional-grade MT5 White Label package typically includes:

- MT5 Trading Platform Access: A branded MT5 interface for your traders with your own name and logo.

- Back-Office Management: Full access to user administration, reporting, and account control.

- Liquidity Connection: Integration with liquidity providers to offer competitive spreads and execution.

- MT5 CRM Integration: Seamless CRM connectivity to manage leads, KYC, deposits, and retention.

- Bridge & Risk Management Tools: Tools to manage exposure, pricing feeds, and order routing.

- Technical Support & Maintenance: Continuous hosting, monitoring, and updates handled by your provider.

With an MT5 White Label, brokers can enter the market in as little as 2–4 weeks, compared to months of setup for a full license and infrastructure build.

What Are the Legal Requirements for an MT5 CRM?

Here’s where precision matters most. Operating an MT5 White Label doesn’t automatically make you a regulated broker, but it does place you in a financially sensitive environment that’s governed by jurisdictional and compliance standards.

1. Licensing Requirements

To operate legally, you generally need a forex broker license or authorization from a recognized financial authority. However, the specific requirement depends on your business model:

- Regulated Brokers: Must obtain a full license (e.g., CySEC, FCA, ASIC) and comply with KYC, AML, and reporting obligations.

- Unregulated or Offshore Brokers: Can operate under an offshore registration (e.g., Seychelles, Belize, St. Vincent), but this limits client reach and trust.

- Prop Trading Firms: Usually do not require a broker license since they don’t hold client funds, but they must ensure compliance with advertising and data protection laws.

2. Data Protection & Client Privacy

Whether regulated or not, you must comply with data protection frameworks like GDPR (for EU clients) or equivalent local laws. Your MT5 CRM must securely handle client onboarding data, transaction history, and payment information.

3. AML/KYC Procedures

Your CRM must support Know Your Customer (KYC) and Anti-Money Laundering (AML) functionality to verify client identities and monitor suspicious activities. Providers like Leverate include automated KYC integrations and verification workflows that help meet compliance standards without manual complexity.

4. Client Fund Segregation

If your business model includes managing client funds, regulators will require segregated accounts, transparent reporting, and detailed reconciliation processes.

5. Technology & Data Hosting Jurisdiction

Data hosting locations matter for compliance. For example, brokers serving EU clients should ensure servers and backups comply with EU data residency requirements.

In short, even though an MT5 White Label lowers your entry barrier, you’re still responsible for operating legally and ethically within your chosen jurisdiction.

Key Advantages of MT5 White Label

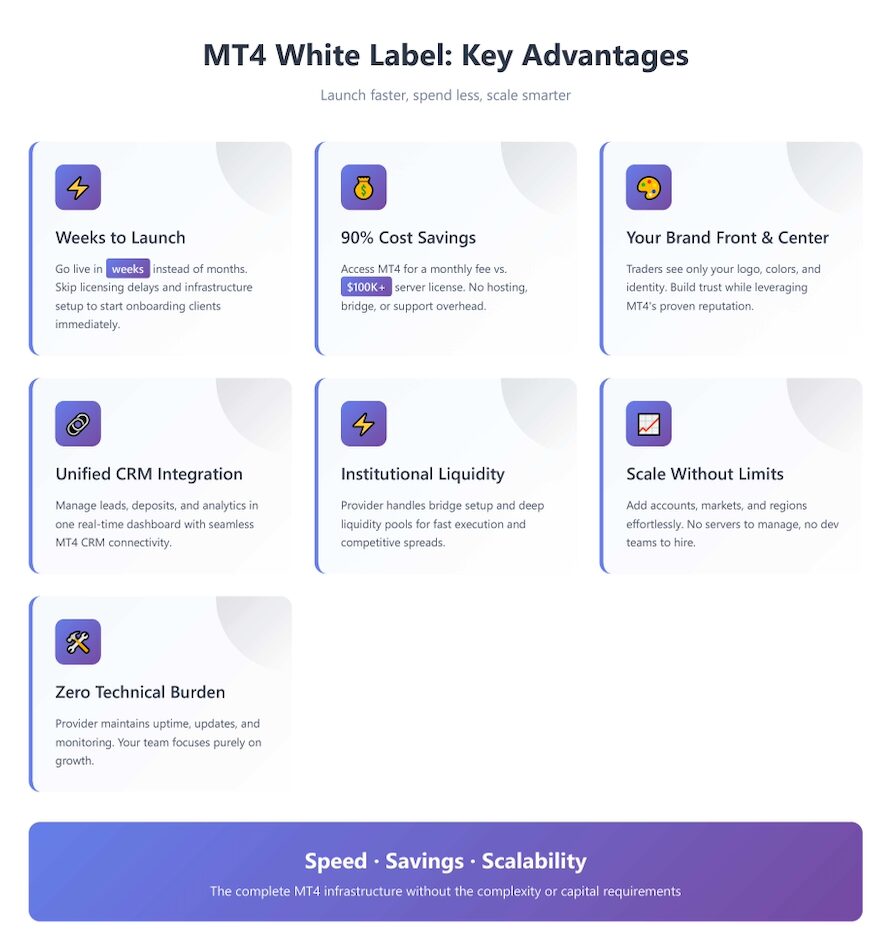

Opting for an MT5 White Label isn’t just about cost; it’s about speed, scalability, and branding power. Here are the core advantages:

1. Rapid Market Entry

Launching a full brokerage from scratch can take months of licensing, tech setup, and infrastructure work. With an MT5 White Label solution, you can go live in a matter of weeks and start onboarding clients quickly.

2. Cost Efficiency

Purchasing a full MT5 server license from MetaQuotes can cost upwards of $100,000 USD, not including hosting, bridge, and support. A White Label lets you access the same technology at a fraction of the cost, typically via an affordable monthly or annual subscription.

3. Full Branding Control

Your traders see your name, your logo, and your brand colors, not your provider’s. This ensures professional presentation while leveraging MT5’s trusted reputation.

4. Seamless MT5 CRM Integration

Integrating your White Label with an MT5 CRM gives you a single environment for managing leads, client activity, deposits, and analytics, all in real time.

5. Advanced Liquidity and Execution

Your provider handles liquidity integration and bridge setup, giving you access to fast execution and deep pricing pools, critical for maintaining tight spreads and competitive performance.

6. Risk-Free Scalability

Since you’re not maintaining servers or development teams, you can scale your brokerage effortlessly. Add new accounts, markets, or regions as your business grows without rebuilding your infrastructure.

7. Support and Maintenance

Technical headaches? None. The provider maintains uptime, updates, and system monitoring, so your team can focus entirely on marketing and growth.

How Much Does Setting Up an MT5 White Label Truly Cost?

Let’s tackle the question every broker asks: what’s the real cost of an MT5 White Label solution?

While pricing varies by provider, here’s what to expect:

1. Setup Fee

A one-time setup fee typically ranges between $5,000 and $15,000 USD, depending on customization, integrations, and branding. This covers:

- MT5 server configuration

- Bridge setup

- CRM integration

- Platform branding (logo, color scheme, etc.)

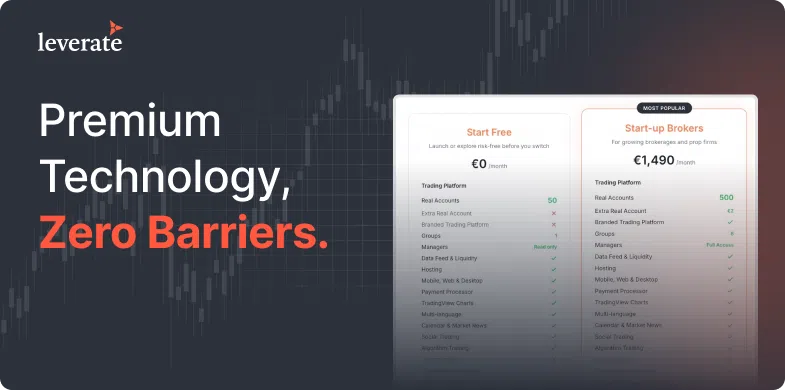

2. Monthly License Fee

You’ll then pay a monthly technology fee, which usually ranges between $1,000 and $3,000 USD. This covers hosting, updates, and ongoing technical support.

3. Liquidity Costs

If your provider bundles liquidity, expect markup-based pricing or volume-based fees. Most brokers opt for tiered liquidity models that adjust as volumes grow.

4. CRM Integration

Adding an MT5 CRM is often part of the package, but advanced CRM features (like affiliate tracking, KYC automation, and client analytics) may come at an additional monthly cost.

5. Additional Services

Depending on your provider, you may also incur fees for:

- Compliance consulting

- Payment gateway setup

- Marketing automation tools

- Custom development or reporting dashboards

Cost Summary

| Component | Typical Cost (USD) |

| Setup Fee | $5,000 – $15,000 |

| Monthly Fee | $1,000 – $3,000 |

| Liquidity | Variable per volume |

| CRM Add-on | $300 – $1,000 monthly |

| Compliance Services | Optional / per jurisdiction |

Overall, a well-structured MT5 broker White Label solution costs far less than acquiring a full MT5 license, while offering the same professional-grade technology, scalability, and security.

MT4 vs. MT5 White Label – A Quick Comparison

While MT5 is the newer platform, MT4 remains the industry favorite thanks to its proven reliability, massive community, and wide EA (Expert Advisor) compatibility.

However, many brokers now choose to diversify by offering both MT4 White Label and MT5 White Label platforms to meet trader preferences.

| Feature | MT4 White Label | MT5 White Label |

| Market Focus | Primarily Forex | Multi-Asset (Stocks, Futures, Crypto) |

| Execution Speed | High | Higher |

| Compatibility | Strong EA & Script Library | Expanding Developer Support |

| Cost | Lower | Higher |

| Ideal For | Forex Brokers & Prop Firms | Multi-Asset or Expanding Brokers |

If you’re entering the market or running a smaller brokerage, MT5 remains the most practical and cost-efficient choice, especially when paired with a reliable provider that includes CRM, liquidity, and risk management under one roof.

FAQ

1. What is an MT5 White Label solution?

An MT5 White Label is a fully branded version of the MetaTrader 4 trading platform provided by a technology partner. It allows brokers to offer MT5 trading under their own brand without purchasing a full MetaQuotes license.

2. What is the difference between an MT5 White Label and a full license?

A full license gives you ownership and control of the MT5 server infrastructure but costs significantly more and requires technical expertise. A White Label offers the same front-end experience but is hosted and maintained by your provider.

3. How much does an MT5 White Label cost?

Setup costs can typically range between $5,000–$15,000, with monthly fees from $1,000–$3,000. Additional costs may apply for CRM, liquidity, and support services.

4. Do I need a forex broker license to start with an MT5 White Label?

Yes, if you plan to hold client funds or offer leveraged trading. However, prop trading firms may operate without a license since they trade company funds rather than client capital.

5. How long does it take to launch with an MT5 White Label?

Depending on customization, you can typically launch in 2–4 weeks once onboarding, integrations, and branding are complete.

Conclusion

An MT5 White Label solution remains one of the fastest, most affordable ways to enter the forex and CFD market. By combining your brand identity with MT5’s world-class trading environment, sand integrating with a powerful MT5 CRM, you can create a seamless client experience that drives trust, retention, and long-term growth.Whether you’re launching your first brokerage or expanding your existing firm, partnering with a technology provider like Leverate gives you access to a complete ecosystem, liquidity, CRM, compliance tools, and support, to help your business thrive from day one.