Introduction

Buckle up, readers! We’re about to embark on a financial safari to explore the booming landscape of investment in the heart of Africa.

Africa is often described in the context of being the “final frontier” for investment and is witnessing a dramatic rise in both interest and participation in the trading and forex market in recent times. Beyond its rich cultural heritage and abundant natural resources, the continent is steadily carving a niche for itself in the financial markets. An increasing number of African citizens are not just involved in trading and forex as well as aspiring to be brokers. In this post, we’ll look at some of the reasons behind the growth of the CFD trading and forex market in African countries. We will also focus on the ways Leverate has played a crucial role in helping many aspiring brokers set up their own brokerage businesses. We will also dive into the different marketing channels like Telegram, Facebook, and others that are driving the development of this sector across Africa.

I. Africa’s Forex Frontier: A Landscape in Expansion

1. A big reason for more trading and forex in Africa is that its economy is growing fast and there’s a rapid increase in the use of digital tools. Over recent periods, many African countries have experienced consistent economic growth. This has resulted in an expanding middle class with more spare money to invest. Economic growth is going hand in hand with increased internet access and smartphone usage, allowing more people to engage with online trading platforms and access information.

2. Education in addition to Information accessibility

Information and education access has notably enhanced across Africa. A larger portion of the African population now has access to information and training tools, helping them grasp the intricacies of trading and Forex. Webinars, online courses, as well as tutorials, have been made accessible, making it possible for aspiring traders to learn the necessary knowledge and abilities required to succeed in trading.

II. The Aspiring African Broker: Leverate’s Support

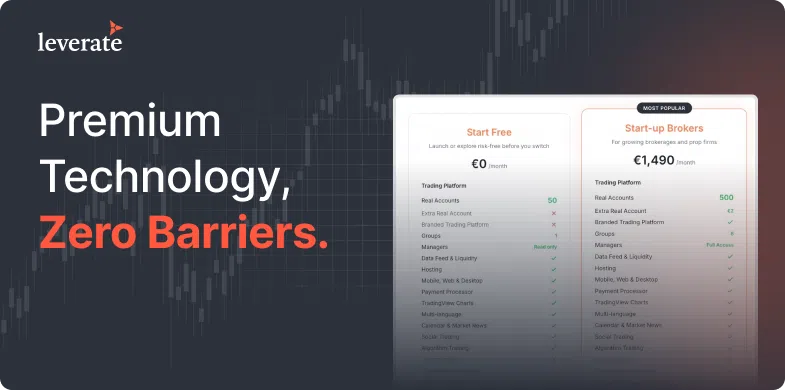

1. Leverate’s Complete Solutions: Leverate, a leading supplier of trading technologies and brokerage services, has been essential in leading individuals from Africa seeking to become brokers. Leverate offers a variety of complete solutions, such as White-Label trading platforms, as well as risk management tools that allow prospective brokers to join the market on a level playing field with an advantage.

2. Customised Support and Consultation

Leverate offers not just technological solutions but also tailored support and mentorship, helping African entrepreneurs steer through the intricate world of brokerage business. Additionally, they guide regulatory adherence and deliver market insights to aid brokers in making informed decisions.

III. Marketing Channels Driving Growth

1. Social Media Engagement

Social media platforms such as Facebook have a major role in promoting trading and forex products in Africa. Brokerage firms utilize these platforms to connect with a wider audience and attract potential clients. They share market insights, educational materials, and promotions to capture and retain customers.

2. Telegram Channels

Telegram is gaining a lot of attention for its marketing and communication channels for trading and forex fans across Africa. Telegram channels devoted to trading analysis and signaling offer traders real-time data and trading possibilities. They foster a sense of community as well as information sharing between traders.

3. Local Workshops and Seminars

Many brokerages that have Leverate’s help hold local workshops and seminars throughout African cities. These are educational platforms as well as networking opportunities for traders. Additionally, they promote the brokerage’s products.

4. Education

*Webinars and online education webinars and online education sessions can be effective for reaching a larger African public. Industry experts and brokers organize webinars in order to discuss insights about trading strategies and market information with beginners and experts.

5. Affiliate Marketing:

Affiliate marketing is increasing demand in the African market for trading and forex. Traders and other enthusiasts earn commissions from referring customers to brokers. The mutually beneficial arrangement encourages people to advertise brokers the services of their.

Conclusion

African trading and forex markets are thriving thanks to economic development, digitalization, and greater access to education and information. Leverate plays a crucial role in aiding upcoming brokers, while marketing channels, including Telegram and local events, bridge brokers and their audiences. As Africa embraces these financial sectors, its market is set for sustained growth and evolution.