What is Liquidity in Forex: A Complete Guide for Traders

Imagine standing in a market that never sleeps, one where trillions of dollars move invisibly across borders, every second of every day. That’s the forex market, and what keeps it alive isn’t just traders or technology; it’s liquidity.

Ask any professional trader what liquidity in forex is, and they’ll tell you it’s the difference between opportunity and frustration. Liquidity determines whether your trade executes instantly or lags for seconds, that costs you profits. It’s what separates smooth, efficient trading from volatile chaos.

But here’s what most traders overlook: liquidity doesn’t just happen. Behind every seamless execution stands a network of forex liquidity providers, technology bridges, and aggregation systems, the invisible architecture that powers the entire industry.

In this guide, we’ll explore what liquidity in the forex market is, why it matters to traders and brokers alike, how to measure it, and how Leverate Prime Liquidity provides brokers withaccess to deep, institutional-grade liquidity and integrations that redefine the trading experience.

What Is Liquidity in the Forex Market?

When people ask what is liquidity in forex, they’re really asking how efficiently currencies can be exchanged. In a liquid market, there’s always a buyer and a seller, ensuring tight spreads and fast execution.

The forex market is by far the most liquid in the world, with a daily trading volume exceeding $7.5 trillion, according to the Bank for International Settlements. Major pairs like EUR/USD, USD/JPY, and GBP/USD dominate, accounting for most of that flow.

High liquidity allows traders to open and close positions almost instantly, with minimal slippage. But during low-volume periods, such as after major news events or holidays, liquidity thins, spreads widen, and prices can move unpredictably.

Learn more about how liquidity connects brokers and markets in our deep dive on liquidity provider in forex.

Why Liquidity Is Crucial for Forex Traders

Liquidity affects every part of the trading experience, from execution quality to transaction costs. Whether you’re an individual trader or a broker managing thousands of clients, understanding liquidity is fundamental.

1. Tight Spreads and Lower Trading Costs

In a highly liquid environment, spreads are narrow because competition among market participants is fierce. That means you pay less per trade, directly increasing your profit potential.

2. Fast and Reliable Execution

High forex liquidity ensures orders are filled instantly. No lag, no frustration, just precision. This is especially important for scalpers and algorithmic traders who rely on microsecond execution.

3. Stability During Volatility

A deep liquidity pool acts as a cushion during market turbulence. More participants mean greater stability large orders won’t cause sudden spikes or crashes.

4. Transparent Price Discovery

A liquid market reflects genuine supply and demand. Prices are shaped by global consensus, not isolated transactions.

Low liquidity, on the other hand, leads to price gaps, erratic movement, and wider spreads. That’s why brokers rely on forex liquidity providers to maintain consistent access to the global interbank market.

Leverate Prime Liquidity empowers brokers to achieve this consistency with aggregated pricing from multiple FX liquidity providers, creating a more transparent and efficient trading environment for clients.

How to Measure Forex Liquidity: Essential Metrics

Understanding what is liquidity in forex also means knowing how to evaluate it. Here are the main indicators professionals use:

1. Volume

Trading volume shows how many transactions occur within a set period. The higher the volume, the deeper the market.

2. Bid-Ask Spread

The spread, the gap between buying and selling prices, is one of the most visible measures of liquidity. Tight spreads usually mean higher liquidity.

3. Market Depth

Market depth reflects how many buy and sell orders exist at different price levels. The deeper the book, the more resilient the market.

4. Slippage

When you enter a trade and get a different price than expected, that’s slippage, a symptom of poor liquidity.

Liquidity peaks during overlapping sessions, particularly between London and New York, when trading volume surges.

Brokers using Leverate Prime Liquidity benefit from aggregated feeds sourced from top-tier forex liquidity providers. This ensures low slippage, optimal pricing, and robust execution, even during volatile market conditions.

Factors That Affect Forex Market Liquidity

Liquidity is never static. It rises and falls based on time zones, events, and macroeconomic shifts.

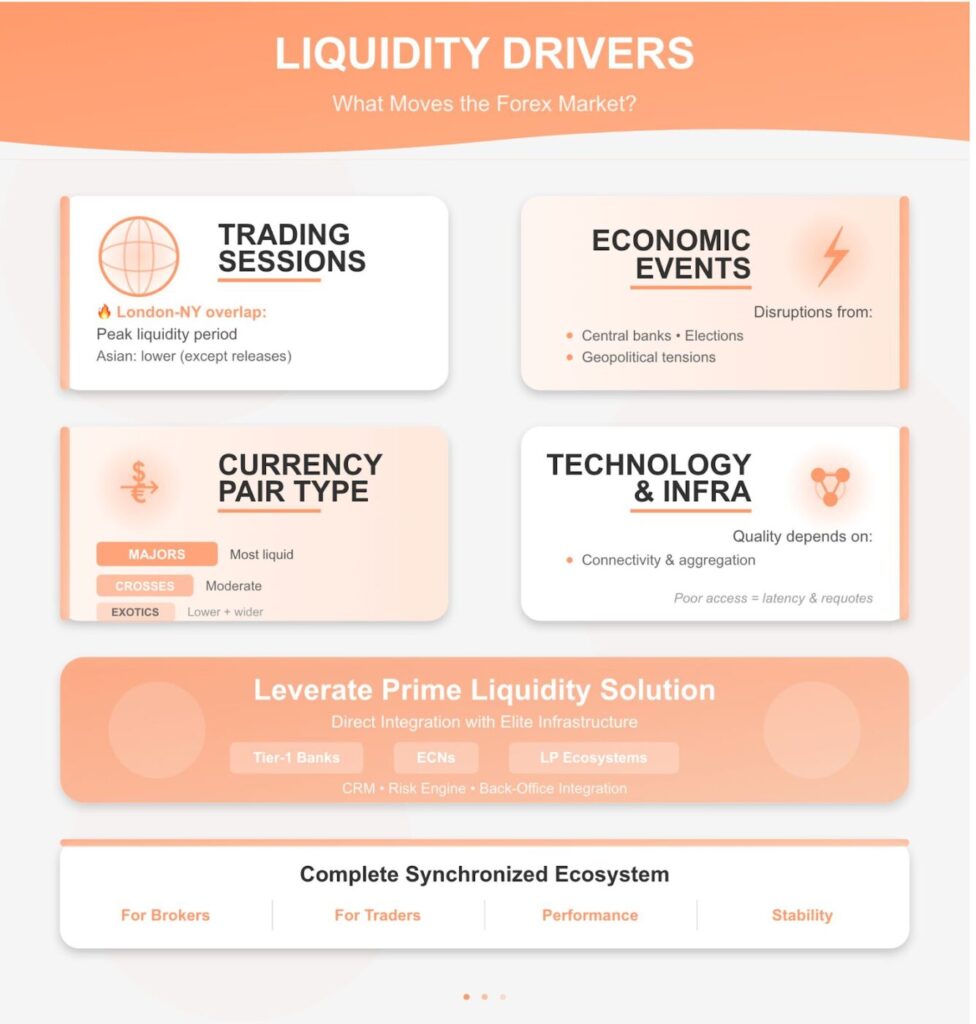

1. Trading Sessions

The London–New York overlap is the most liquid period in forex. The Asian session typically sees lower liquidity except during major data releases.

2. Economic and Political Events

Central bank announcements, elections, or geopolitical tensions can all disrupt liquidity temporarily.

3. Currency Pair Type

Major pairs are the most liquid. Crosses and exotics, like EUR/NZD or USD/TRY, have lower liquidity and wider spreads.

4. Technology and Infrastructure

Execution quality depends heavily on connectivity and aggregation. Brokers with poor access to forex liquidity providers often experience latency, requotes, or failed orders.

This is precisely why Leverate Prime Liquidity integrates directly with Tier-1 banks, ECNs, and liquidity provider in forex systems. Its third-party integrations connect seamlessly with CRMs, risk engines, and back-office solutions, creating a complete, synchronized ecosystem for both brokers and traders.

Leverate Prime Liquidity: The Engine Behind Efficient Forex Trading

For brokers and financial institutions, the difference between average and elite performance often comes down to one thing, liquidity. And that’s where Leverate Prime Liquidity delivers unmatched value.

Here’s what defines Leverate’s offering:

- Deep Aggregated Liquidity: Pricing sourced from top-tier banks and trusted fx liquidity providers ensures continuous, stable execution.

- Ultra-Fast Execution: Leverate’s advanced infrastructure enables millisecond-level trade matching for maximum efficiency.

- Scalability: Whether you’re a startup brokerage or an established firm, Leverate’s liquidity solutions scale with your growth.

- Seamless Third-Party Integrations: Plug in your CRM, risk management tools, and analytics dashboards without technical complexity.

- Transparency and Control: Full visibility into order flow and execution quality — empowering brokers to optimize performance.

With Leverate Prime Liquidity, brokers don’t just access the market, they master it. By combining liquidity depth, speed, and flexibility, Leverate helps brokers deliver the trading conditions today’s traders expect, tight spreads, zero downtime, and institutional reliability.

Conclusion

So, what is liquidity in forex really about? It’s the silent engine that powers every successful trade, the unseen force connecting traders, brokers, and institutions in a $7 trillion marketplace.

In an industry where milliseconds and pips make the difference between profit and loss, Leverate Prime Liquidity gives brokers the edge. It provides not only access to deep liquidity but also the tools to manage it intelligently, from smart aggregation to advanced risk monitoring.

And with third-party integrations that connect CRMs, payment systems, and analytics in one place, Leverate turns complexity into clarity. You don’t just get liquidity; you get a complete, future-proof trading ecosystem.

Building a brokerage that delivers true trading excellence starts with liquidity, and with Leverate, you can offer your traders nothing less than the best.

FAQs

What is liquidity in forex trading?

Liquidity in forex trading refers to the ease with which a currency can be bought or sold without causing significant price fluctuations. A liquid market ensures tight spreads and fast execution (Investopedia).

Which currency pairs have the highest liquidity?

Major pairs: EUR/USD, USD/JPY, GBP/USD, USD/CHF, and AUD/USD are the most liquid due to global participation and high trading volume.

When is the best time to trade forex for maximum liquidity?

Liquidity peaks during the London–New York overlap (8 a.m.–12 p.m. EST), when both financial centers are active.

What is the difference between liquidity and volatility in forex?

Liquidity measures market depth and execution ease; volatility measures price movement intensity. A market can be highly liquid but still volatile.

How does liquidity affect my forex trading costs?

Higher liquidity leads to tighter spreads, faster execution, and reduced slippage, all lowering your overall trading costs.

Sources

- Bank for International Settlements – Triennial FX Survey 2022

- Reuters – Forex Market Overview